- HELP CENTER

- Reports & Payments

- UK & EU VAT

UK brand: How does VAT and the self-billing arrangement work for sales to UK customers?

An explanation of our self-billing arrangement for sales to UK customers

Under the terms of our contract, Wolf & Badger is obligated to collect and remit VAT on all sales to UK customers.

For sales to UK customers, once an order is made we purchase the stock from you and the invoice for this is created in your monthly statement as a "self-billed" invoice from you to us.

You can think of these sales in the same way as if you are selling to any traditional department store, boutique or online retailer. Wolf & Badger sells to the UK customer and handles VAT reporting and compliance.

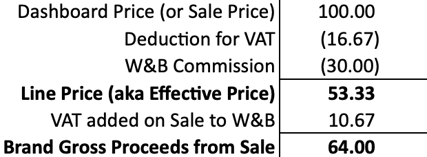

When calculating the payment due to you, we deduct VAT from the product price in addition to our commission as per the following illustrated example:

If you are VAT registered we will add VAT to the amount billed from you to us through the self-billing arrangement and you will receive these additional funds in your monthly payment.

You should therefore remit the VAT amount shown on the self-billing invoices as output VAT in your normal returns to HMRC.