Your sales report is issued on or around the 18th of every month, with payment made within the next 5 working days, usually on or before the 21st of each month (unless this falls on a weekend).

Your report covers the previous full calendar month and makes adjustments for any orders that have been returned between the end of the month and the date the report is generated.

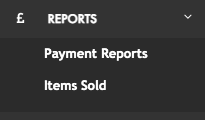

You can access your report by going onto your dashboard and selecting 'reports' and then 'payment reports'.

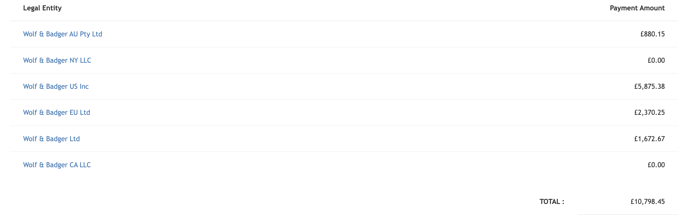

Your reports are divided by 6 different reporting entities:

- Wolf & Badger AU Pty Ltd for sales to customers in AUS.

- Wolf & Badger NY LLC for sales from the New York store.

- Wolf & Badger US Inc. for online sales to US customers.

- Wolf & Badger EU Ltd for online sales to EU customers.

- Wolf & Badger Ltd for all other sales, including the London store.

- Wolf & Badger CA LLC for sales from the LA store.

Types of Reports

Commission Report

For most sales, Wolf & Badger operates as a disclosed agent, selling on your behalf. The commission report will show an itemised list of orders and where the item was fulfilled to (e.g. the customer's location). You will be able to view each item sold, the commission charged on the sale, the order processing fee and whether the order was VATable.

Understanding the Commission Report

The commission report will show an itemised list of orders (excluding those made in or to the UK) and the customer location. You will be able to view each item sold, the commission charged on the sale, the order processing fee and suggested VAT treatment of the sale, if applicable.

- "V" sales are taxable sales for VAT purposes, if applicable.

- "Z" sale are zero-rated sales for VAT purposes, if applicable.

For brands registered for VAT in the EU, it is your responsibility to remit the VAT or other sales tax to the appropriate tax authority

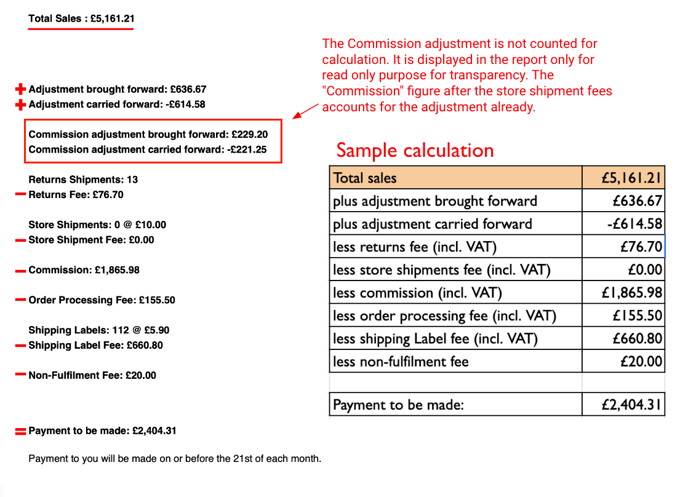

Understanding Adjustments

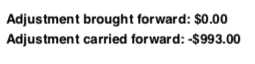

Sales and returns are always listed on the date they occur. However, due to this, 'adjustment carried forward' is used to account for returns that have happened between the end of the reporting month and the date of the report being created. This means that though the sale occurred in the month and will therefore have been included in the report, it has now been returned and this amount will be deducted accordingly from Total Sales prior to payment.

To balance this, this same adjustment amount will then be added to your next sales report as an 'adjustment brought forward', in order to net off against the return which will appear there.

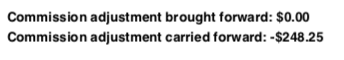

Commission adjustments account for the corresponding commission associated with the returns that may have occurred to make sure you are not charged for sales that are returned.

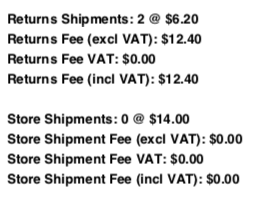

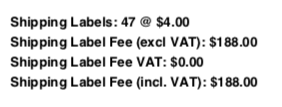

Shipment & Return Fees

Shipment and return fees are calculated per our current standard rates. We will charge VAT on these amounts where applicable.

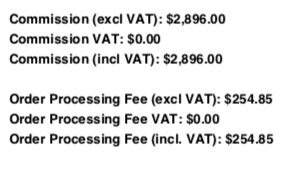

Commission & Order Processing Fees

Commission is the total commission that Wolf & Badger charges and will retain from payments due to you. This is calculated by adding the entire commission column (from the report) plus or minus any commission adjustments. Similarly, order processing fee is calculated by totaling up the order processing fee column (from the report). We will charge VAT on these amounts where applicable.

How to calculate your payment to be made

*N.B. This is per commission report

Total sales

+ adjustment brought forward

+ adjustment carried forward

- returns fee (incl. VAT)

- store shipments fee (incl. VAT)

- commission (incl. VAT)

- order processing fee (incl. VAT)

- shipping Label fee (incl. VAT)

= payment to be made

For example:

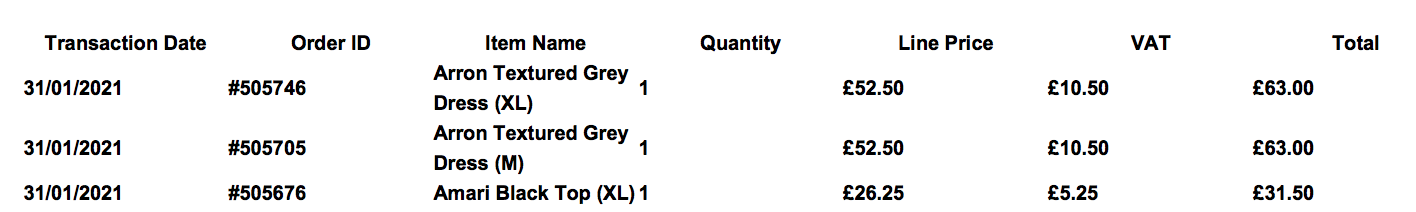

Understanding the Self-Billed Invoice

For orders to UK and EU customers only, Wolf & Badger operates as an undisclosed agent for the sale. This means that end customers in the UK and EU contract with and are invoiced by Wolf & Badger for these orders and there is a supply from you to Wolf & Badger and a separate supply from Wolf & Badger to the end customer. For these sales, we collect VAT at the point of sale and remits these monies to the applicable tax authorities. To facilitate this arrangement, we create an invoice on your behalf for the supply of goods made by you to us for these orders only. These sales will appear on your Self-Billed invoice.

The sales invoice generated from you to us will show the amount paid to you by Wolf & Badger in the form of the Line Price. Order Processing fees, returns fees, and label fees relating to orders on this report will show separately in you commission report.

Example Line Price Calculation

.png?width=500&height=254&name=Screenshot%202023-08-10%20at%2010.21.34%20(1).png)